In 1999, Senators Emmett W. Hanger, Jr. and Creigh Deeds co-sponsored legislation that led to the unanimous and bipartisan passage of the Virginia Land Conservation Incentives Act of 1999. That act ultimately led to Virginia’s Land Preservation Tax Credit (LPTC), a program that provides landowners with tax credits in exchange for voluntarily limiting future development on their land and, in the process, conserving important natural, cultural, scenic and historic resources.

In late April, at the Virginia Land Conservation and Greenways conference in Harrisonburg, Senator Hanger proudly announced the permanent protection of over 1 million acres of land as a direct result of the LPTC. “The land preservation tax credit was a joint effort coming out of the Commission on the Future of Virginia’s Environment,” Hanger said. “None of us imagined that it would be as big as it would be.”

PEC President Chris Miller recalls, “We’d just defeated Disney’s America, and on the heels of that, the [then-Speaker of the House Thomas] Moss Commission on the Future of Virginia’s Environment found that water quality and sprawl were top concerns among Virginians. The Commission set about imagining a market-based plan for localities that wanted to protect their lands and waters through conservation.”

A tax credit for voluntary land protection was part of that, and PEC was a leader every step along the way, Miller said. Tim Lindstrom, PEC’s staff attorney at the time and a national expert on conservation easements and land use policy, was tapped to draft the original language that led to the legislation, he said.

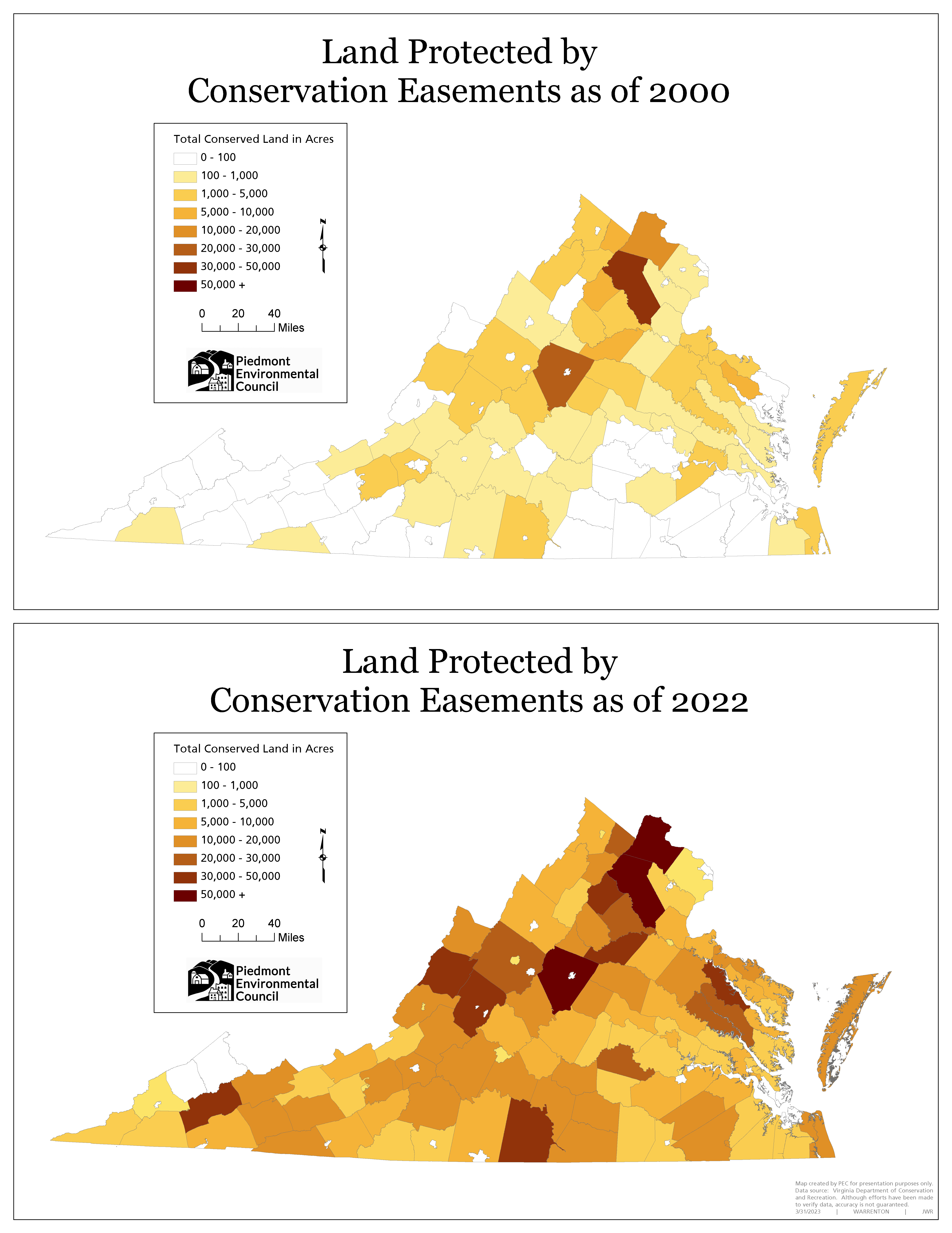

Today, the LPTC has become the single largest factor in Virginia’s land conservation success, dramatically increasing the pace and scale of conservation in the Commonwealth. In the 35 years prior to its passage, according to Virginia Department of Conservation and Recreation data, roughly 175,000 acres had been permanently protected by conservation easements in Virginia. In the 22 years since, more than seven times that amount, totaling more than 1,275,000 acres, have been conserved statewide, making Virginia a national leader in private land conservation.

More than five times larger than the Shenandoah National Park, the 1 million acres protected through this nationally acclaimed program benefit all Virginians by providing clean air and safe drinking water, increasing access to nature, and supporting job-creating industries such as agriculture and forestry. In addition, the resulting land protection is critical to meeting an array of public policy objectives ranging from farmland protection and climate resilience to meeting the goals of the Chesapeake Bay restoration effort.

Important in Virginia’s conservation success is that Virginia is one of only five states that makes its land preservation tax credits transferable, which Miller said was a move that came out of many conversations about how to help landowners and small family farmers whose taxable income wasn’t high enough to benefit from the tax credits.

“There were a lot of families that wanted to conserve their land, but couldn’t afford the transactional costs of donating an easement and did not have enough income to take full advantage of the new tax credit,” Miller said. Again, PEC first worked with the General Assembly to enact the Open Space Lands Preservation Trust Fund, administered by the Virginia Outdoors Foundation, to help cover the costs affiliated with doing an easement. We also successfully advocated to make conservation an option for those who couldn’t use the tax credit, by enabling the gifting or sale of tax credits.

By allowing landowners with a wide range of economic circumstances to benefit from these tax incentives, the Land Preservation Tax Credit has accelerated the rate of conservation dramatically and vastly expanded the map of conserved land across the Commonwealth,” said Ellen Shepard, executive director of Virginia’s United Land Trusts. Ultimately, tens of thousands of acres are permanently protected in Virginia each year at a fraction of the cost it would take for the Commonwealth to acquire the land needed to meet its conservation and water quality goals.

Clyde Evely, who with his wife Betty, protected 57 acres in the historic Catawba Valley in Roanoke County and adjacent to the Appalachian Trail, said, “the land tax credit allowed us to keep the farm in the family and in farming. It has allowed us, as older farmers, to rest easy that we can meet our financial obligations.” Betty added that as development pressures increase in their mountain valley, they are able to “maintain an active farming operation, preserve views for Appalachian Trail visitors, and upgrade fencing and other farm infrastructure.”

Kathy Wilt remembers well growing up on her grandparents’ 12-acre farm in Loudoun County, milking cows, feeding farm animals and tending to the garden. “This donation of easement was a very emotional decision, and it’s satisfying that the land will be kept in open space for perpetuity. Due to its location within the Village of Taylorstown and the zoning, there was potential for high density development, so donating the easement is peace of mind that this will not happen,” Wilt said.

“We wanted to do something for the greater good and it’s always been important to us to protect nature. The tax credits helped us pay for the land, and it was the best investment we could have ever made,” said Lynn Cameron, who protected 168 acres adjacent to Shenandoah National Park through the LPTC.

In its decades of work promoting land conservation, PEC recognized early on the need for improved incentives for land conservation to help offset the loss of economic value from easement donation. Today, PEC continues to be a primary advocate for the Land Preservation Tax Credit within the General Assembly and state government. “The LPTC remains a top priority in PEC’s state policy work and is the backbone of our on-the-ground conservation work,” Miller said.

“I count myself fortunate for the opportunities I have had over the years to be involved in numerous areas that have contributed positively to the quality of life we enjoy in the Commonwealth,” said Hanger. “The work we did over 20 years ago in the Commission on the Future of Virginia’s Environment is an excellent example of bipartisan efforts that will continue to pay off great dividends to future generations of Virginians in both tax incentives and land preservation.”

This article appeared in the 2023 summer edition of The Piedmont Environmental Council’s member newsletter, The Piedmont View. If you’d like to become a PEC member or renew your membership, please visit pecva.org/join.