A decision is being considered that could have a profound and lasting effect on the integrity of conservation easement programs in Virginia.

Land Conservation Policy

Public policy decisions impacting land conservation in the Commonwealth.

General Assembly eyes further cuts to land conservation

The Virginia General Assembly will kick off on January 11, 2017, and with a budget shortfall weighing heavily on the minds of our legislators, a lot of cuts are being discussed. Of particular concern is HB 1470, which would substantially reduce the tax incentives for land conservation.

Legislation to Benefit Land Conservation

We are excited to announce that Congress recently passed legislation to permanently enhance the federal income tax deduction for the donation of a conservation easement. The new law allows conservation easement donors to deduct their donation at the rate of 50 percent of their Adjusted Gross Income (AGI) per year, and they can carry forward any excess contribution for as many as 15 years. Further, a qualified farmer can deduct their easement donation at the rate of 100 percent of AGI per year, potentially paying no federal income tax for the next 15 years.

Conservation Easement Enforcement Goes Before the Virginia Supreme Court

UPDATE: On Feb 12, 2016, the Virginia Supreme Court issued a ruling in Wetlands America Trust, Inc. v. White Cloud Nine Ventures, L.P. The decision by the Virginia Supreme Court affirms the validity of perpetual conservation easements in the Commonwealth. Troublingly though, the court clarified the standard of review for conservation easements as “strict construction,” which means the presumption on any ambiguity will be a finding in favor of the “free use of land.”

At a practical level, the ruling will impact how land trusts steward current easements and underscores the importance of specificity in the drafting of future easements.

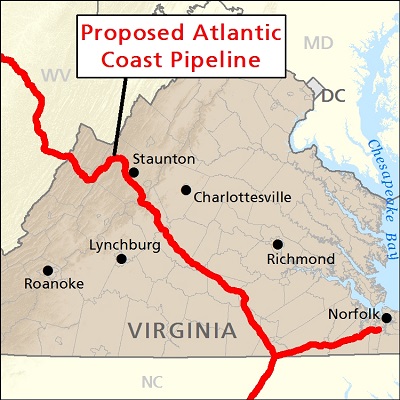

‘Fracking’ on Conserved Land?

The Virginia Outdoors Foundation (VOF) is an important state public agency that has taken part in conserving land in the Commonwealth since 1966. Today, VOF is the largest easement holder in Virginia, and PEC is proud to have partnered with them over the decades. Over the past two years, however, VOF reviewed and approved a number of new easements permit oil and gas drilling—including the potential for hydraulic fracturing (a.k.a. “fracking”)—in areas that have little to no history of energy extraction.

Relevant IRS Notices and Comments

Guidance from the IRS on qualified conservation contributions.

Federal Tax Incentives (Downloadable PDFs)

Forms, codes, and more information about tax incentives.

Forms (Downloadable PDFs)

The forms you will need to receive a Virginia tax credit.

State Income Tax Credit – Frequently Asked Questions

Answers to your questions: